Clearly at an important point at the moment: Copper. In USD terms as well as against Gold, Copper is at extremely crucial points with regards to the short to medium term. The recent sideways action will result in some kind of larger move either way.

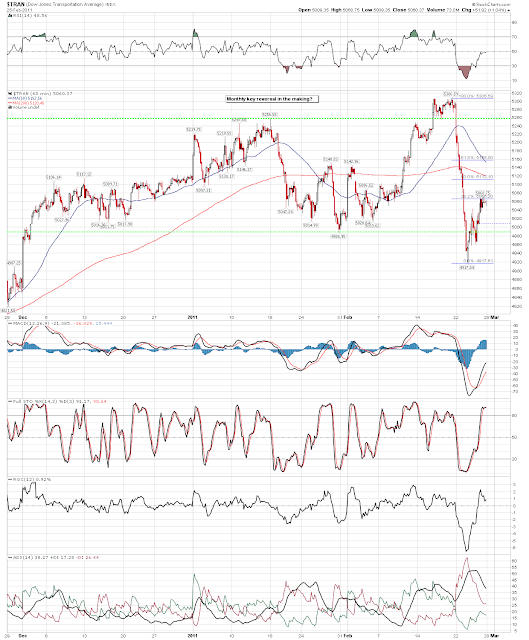

TMN has been making the case for a major top building process being under way and therefore still favours selling rallies in 'risk'.

Oil and Silver will find a top at some stage, just like they did in Summer of 2008.

TMN believes firmly that there will be at least a temporary break to endless liquidity provision and markets are starting to look at this now.

This sobering process is likely to show quickly in the real economy. Purchasing prices are already hurting some it seems.

Volatility has bounced off the 16 area on multiple occasions over the last 2 years and it seems that now it is attempting to gather some steam for a significant advance into summer.

TMN has been making the case for a major top building process being under way and therefore still favours selling rallies in 'risk'.

Oil and Silver will find a top at some stage, just like they did in Summer of 2008.

TMN believes firmly that there will be at least a temporary break to endless liquidity provision and markets are starting to look at this now.

This sobering process is likely to show quickly in the real economy. Purchasing prices are already hurting some it seems.

Volatility has bounced off the 16 area on multiple occasions over the last 2 years and it seems that now it is attempting to gather some steam for a significant advance into summer.