As everyone who has not suffered brain damage will understand, stock markets, for the last 2 years, have been fuelled exclusively by the availability of cheap money. The tide is about to turn. It is a process and it will not happen over night. The markets however will be anticipating the action in advance. TMN has called for a pause in the decline of the bond market a few weeks ago and we have seen a decent bounce since then. In order to achieve a breakout on the top USH1 needs to rise above 122-09.

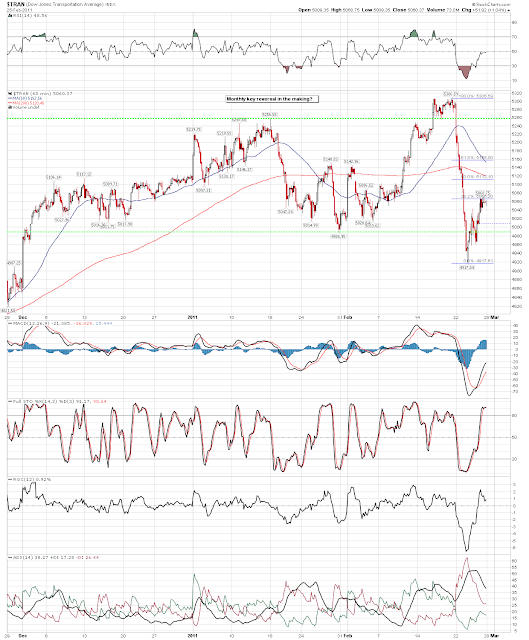

As per TMN's last post a couple of weeks ago, "risk" is topping out and especially TRAN has not been looking good lately. In fact, the TRAN are very close to a bearish monthly key reversal.

The USD saw some pressure last week but recovered on Friday. On the weekly charts it is pretty clear that major support is coming in now. TMN is confident that it will hold and bounce off there. 81.44 remains the key level that will turn the USD view of most participants upside down once it trades.

And finally one of the most important big picture charts TMN can think of: